Did You Know?

2024

Top Performing School Districts and Schools in Rock County

RCF believes a quality education leads to greater freedom and liberty for the student, and our community.

RCF would like to congratulate these 19 outstanding Rock County school districts and schools which scored an overall four or five star rating on the ‘22-’23 WI DPI annual report cards. The students and teachers in these districts and schools achieved above average scores and should be congratulated for the commitment to excellence!

Rock County property taxes are in the top 3% of all (3143) US counties, and are even higher than in Dane County property taxes, based on percentage of property value!

Financial freedom is less about financials and more about personal freedom

In Rock County, your property taxes are assessed by the county and Blackhawk Technical College, as well as your city/municipality and school district. It is your elected representatives who oversee these local governmental bodies and are responsible for setting their tax levies. This is what drives your individual property taxes. If you would like to speak to your local elected officials directly, you can find their contact information HERE.

Fair taxation has to take into account the citizen’s ability to pay the taxes, among other factors. Our local elected officials on county, municipal, and school district boards are entrusted to maintain FISCAL RESPONSIBILITY. Collectively, these boards have led to this high taxation issue in Rock County. So as a citizen, your role is to elected officials who will be focused on FISCAL RESPONSIBILITY and have proven so through action.

According to 2024 Tax-Rates.org, Rock County property tax comparison to the US:

- MEDIAN PROPERTY TAX: If Rock County median property taxes, as a percentage of median income, are 255th out of 3143 counties across the US, this puts Rock County property taxes in the TOP 8% in the US!

- PERCENTAGE OF INCOME: If Rock County property taxes, as a percentage of income, is 143 of 3143 counties across the US, this puts Rock County property taxes in the TOP 5% in the US!

- PERCENTAGE OF PROPERTY VALUE: If Rock County property taxes, as a percentage of property value, is 100th (1.96% of property’s assessed fair market value) out of 3143 counties across the US, this places Rock County property taxes in the TOP 3% in the US!

Rock County property tax vs Dane County:

- Rock County property taxes (1.96%) are even higher than Dane County (1.8%) property taxes, based on a percentage of property value!

To stay in the loop, sign up for RCF e-updates on our main page HERE.

Rock County School Districts’ Concerning Trends, Yet the Desire for More Funding

Rock County School Districts’ Concerning Trends, Yet the Desire for More Funding

WHY DOES THIS MATTER?

Education freedom is a concept that refers to the ability of parents to select the best educational opportunity for their children. It recognizes that all children are unique, full of potential, and deserving of a high-quality education that meets their individual needs. For someone to be truly free, they must receive a high-quality education that allows them to maximize their full potential in life.

Recently RCF announced the top-performing public school districts and schools in Rock County. We recognize the teachers and students for their commitment to excellence, and to education freedom!

WHERE DOES THIS DATA COME FROM?

The WI Department of Public Instruction (DPI) annually releases their reports on all public school districts across WI. The most recent data is from the 2022 – 2023 school year. The data used to create this document was provided by DPI, and can be found here.

WHAT CAN BE DONE WITH THE INFORMATION IN THIS DOCUMENT?

There are a multitude of reasons for these concerning results and this document is not intended to place blame on the teachers or students. The way the system is intended to work is you must elect people to the Board of Education who will address these issues, and in turn, they hire an administrator who is committed to delivering educational excellence. Therefore, research your Board of Education candidates in each Spring election, support their campaigns and give them your vote. That is, YOU also share responsibility for education freedom in Rock County!

Also, use this information to have a conversation with your local elected Board of Education member in your school district.

- On average, Rock County schools rank equal to the 257th ranked school district in WI, this is down 16 positions from the prior year.

- On average, Rock County students underperform the state average in English Language Arts and Math proficiencies, by 7% and 20% respectively.

○ Rock County has also lost ground vs State averages last year.

○ Nearly every school district ELA and Math scores were down year-over-year - The two largest school districts in Rock County, Beloit and Janesville school districts, are the lowest ranked in the county, and both “Meet Few Expections”

○ Beloit is currently ranked 420th out of 421 school districts in WI

○ Janesville ranks 399th out of 421 school districts in WI

How does your school district compare? See data

SPENDING ON STUDENTS IN ROCK COUNTY

A common stated concern is we are not spending enough to adequately teach the children. Additionally, four school districts have approved additional spending referendums on the Spring ballot – Beloit ($9M every year through the 2026-2027 school year for operational expenses), Edgerton ($3.5M for operational costs), Evansville ($22.3M over the next five years for operational expenses), Parkview ($2.3M operational referendum). Both Beloit and Parkview had spending referendums in 2023 which failed.

Perhaps all four school spending referendums failed in 2023 was because of one or more of the following reasons:

- The lack of academic achievement results with the funding already provided to the school districts. (See data)

- School enrollment numbers are on the decline across the state, and in Rock County. See the Rock County School District research released last March from the RCF Watchdog team.

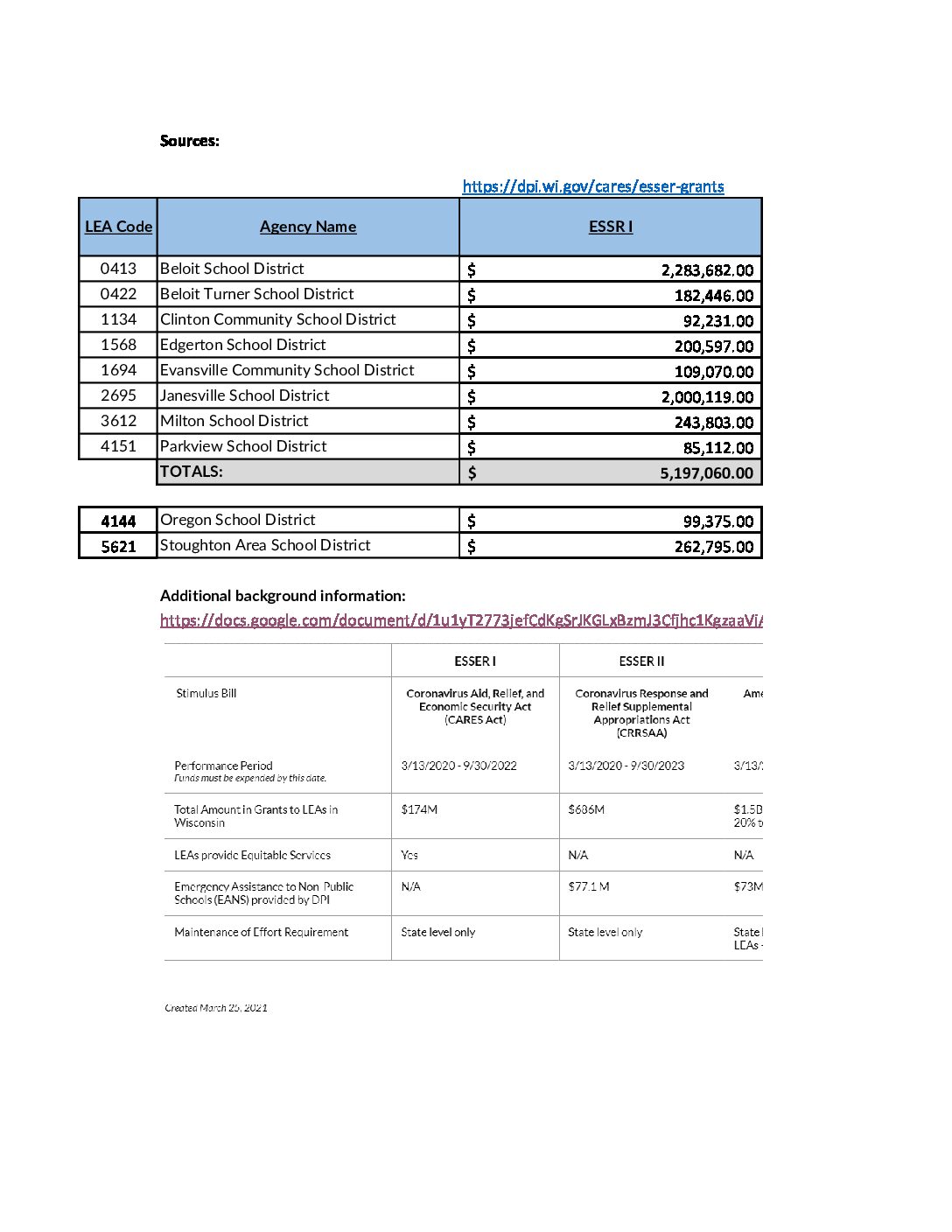

○ According to DPI scorecard reporting, Rock County student enrollment is down 253 students, or-7.4% over the past 5 years. - Schools became comfortable with the ESSER (COVID) funding and are having difficulty right-sizing to post-COVID budgets. View the Rock County School District research from last March for more details.

- Reports indicate there is not a direct relationship between per student funding, and academic achievement. ○ Case in point: The highest spend per student in Rock County was in the Beloit School District ($17,852), yet the district is the lowest-rated school district in Rock County and next to last in WI (420 of 421 districts)

- People in today’s inflated economy are already paying for more than their fair share, particularly given property taxes in Rock County are higher than 95% of all US Counties (3143 counties), based upon percentage of income.

- People are not sure they are “getting their money’s worth.”

How does your school district’s spending per student compare? See data

2023

Proposed 2024 Rock County Budget | Unsustainable

● Rock County is the 10th-largest county in the state yet has the highest property taxes, with a county average effective rate of 2.08% (Source: smartasset)

● Peer county comparisons demonstrate Rock County tax levy and mill rates are historically the highest of the group

● Rock County Administrator, Josh Smith, recently stated “using the General Fund to control the tax levy is unsustainable,” and is therefore is recommending to County Supervisors to decrease the proposed 2024 operating budget

● The proposed gross tax levy (without General Fund funds applied) is projected to increase by a whopping 12.2%/$9.0M in 2024! The average annual increase over the previous 5 years was only 2.25%.