Key takeaways:

- It is the 2026 budget season for local governments. Time to learn about how much you are taxed, locally, and get engaged with your local representatives to ask questions. This document is meant to help you to have these conversations!

- County debt and expenditures are outpacing Rock County citizens’ ability to pay, and the growth in population in the county. Unsustainable!

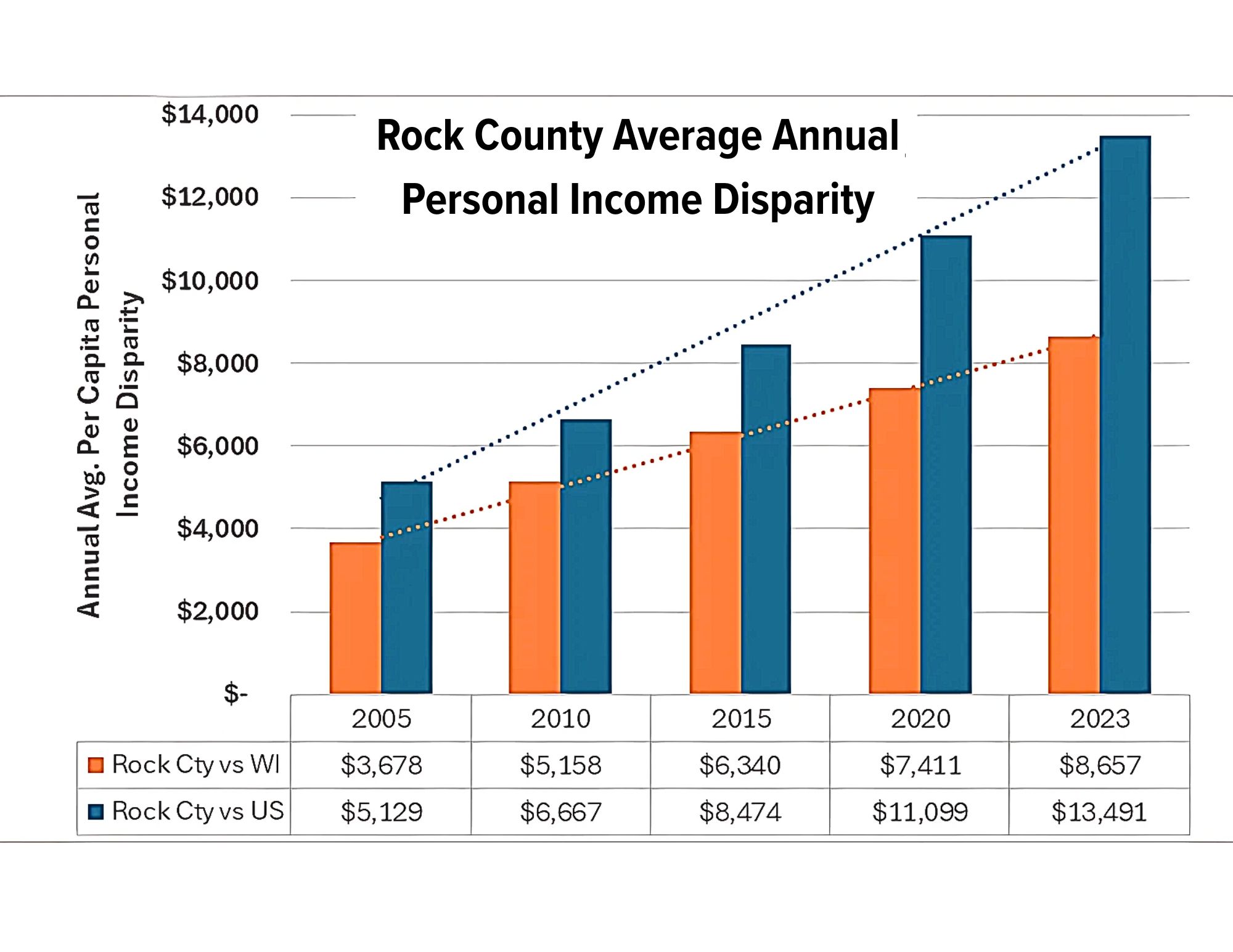

As reported in a previous RCF Did You Know (DYK) document, property taxes in Rock County are out of proportion with the citizens’ ability to pay, due to a systemic lagging personal income in Rock County. More specifically, Rock County’s property taxes are higher than 96% of ALL counties in the US, relative to personal income. This inequity is created primarily by county, school district and municipality taxing authorities assessing tax levies which collectively do not adequately take into account Rock County citizens’ abililty to pay – in relation to the average personal income in the county. (Source: https://www.tax-rates.org/wisconsin/rock_county_property_tax).

The lagging average personal income in Rock County has been steadily increasing every year, reaching $8,657 in 2023, compared to the WI state average. Additionally, this lag is growing at a faster rate than the US average ($13,491 in 2023).

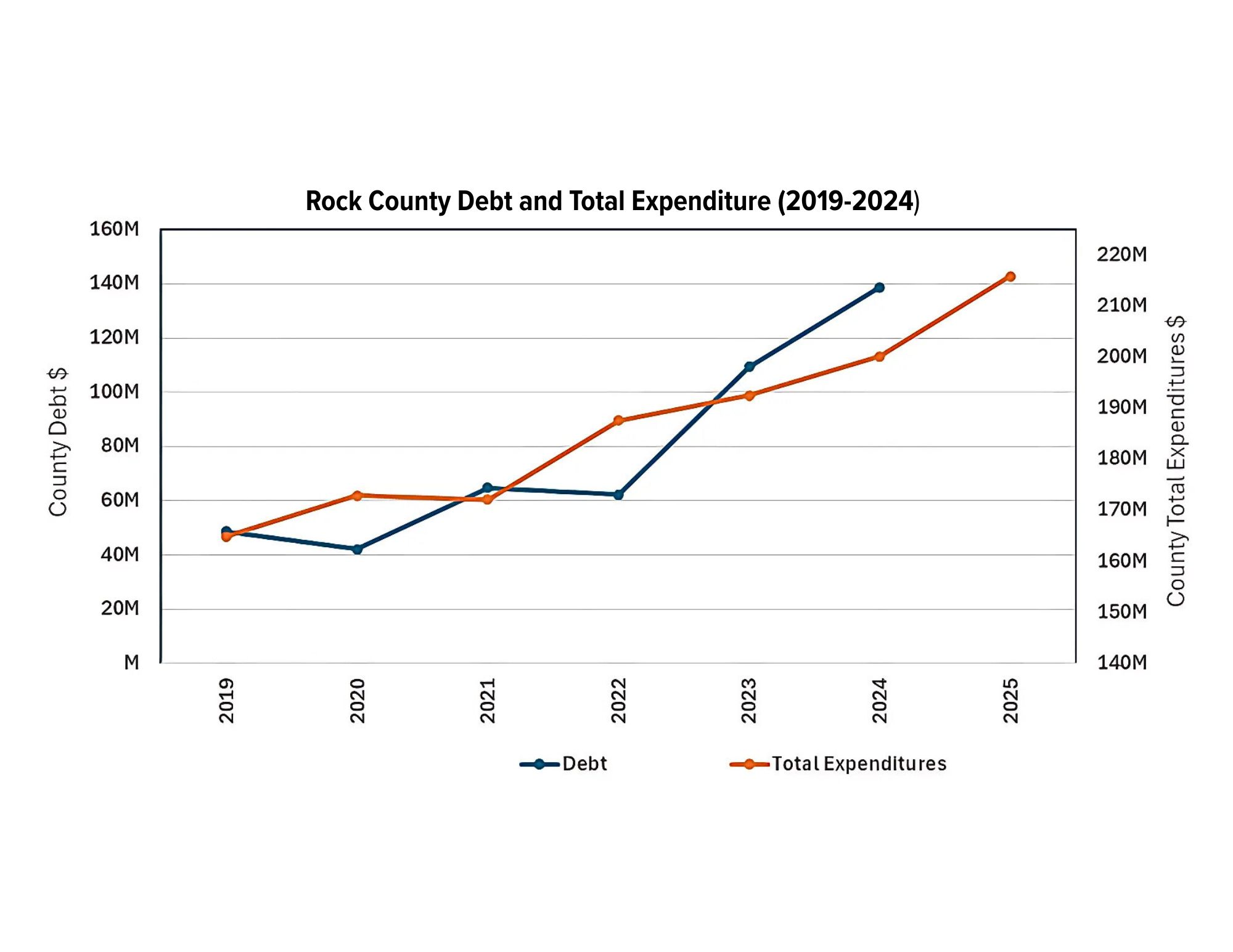

County Debt and Total Expeditures (2019-2024/2025) Between 2019 and 2024/2025, total annual expenditures increased by $51M/31%, while total debt increased by a staggering $90M/185%. The 2023 and 2024 debt increases were driven by the new County Jail complex, but debt was already increasing between 2019 and 2022.

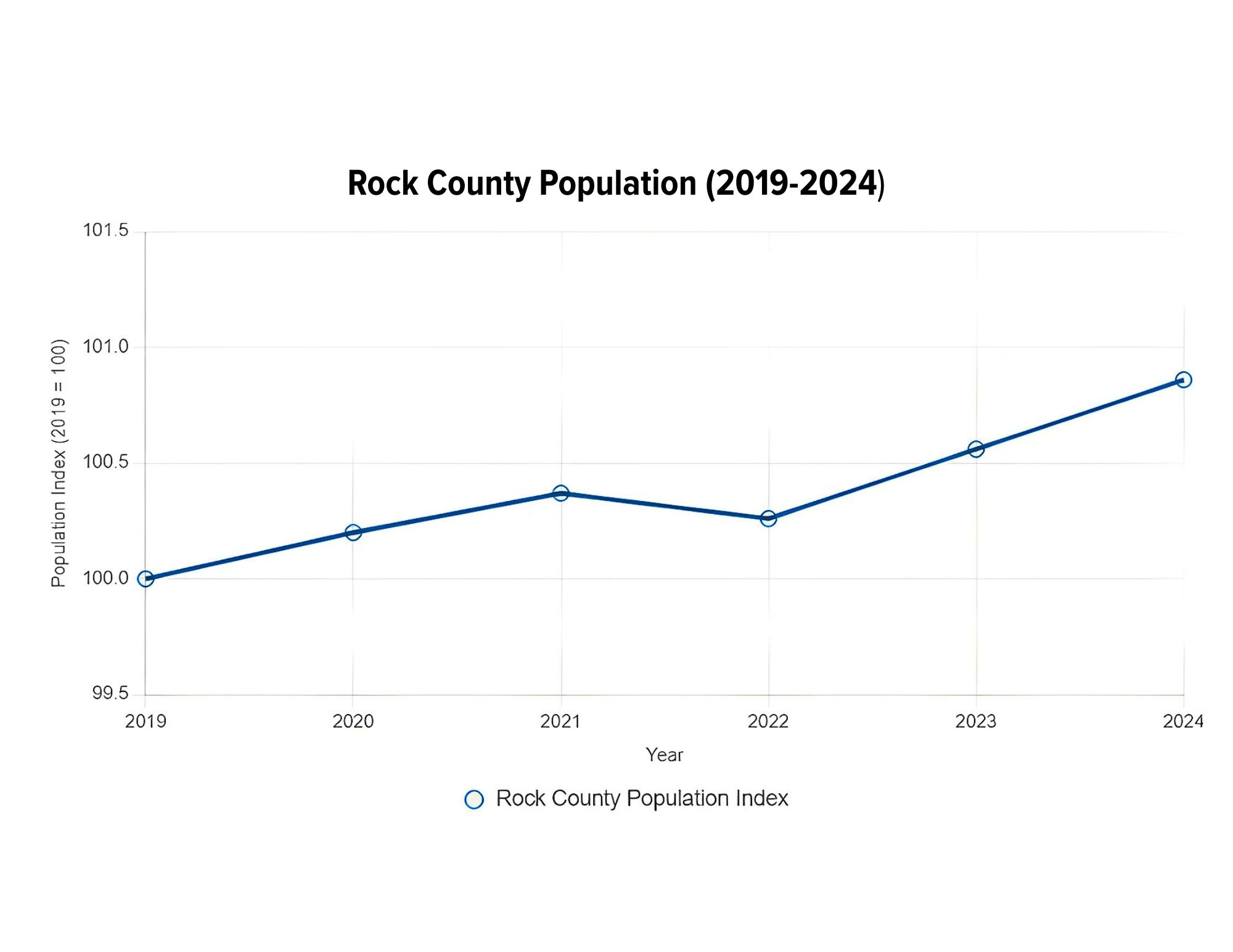

Estimated County Population Growth (Normalized – 2019-2024) County total expenditure and debt are growing much faster than the population. Rock County’s population grew slowly from 163,354 in 2019 to an estimated 164,771 in 2024, a total increase of 0.86% over five years (average annual growth of about 0.17%).

This means Rock County is spending $1310 per citizen in 2025, $300/30% more than in 2019.

Looking Forward to 2026 Budget

Currently the County Board is working on the budget for next year. The 2026 budget will be voted upon on November 12th. This is when they determine the 2026 tax levy. We encourage the County Board to reel in expenditures, debt, and most importantly the tax levy so it better aligns with population growth and the personal income level of the tax base. The citizens of Rock County are already paying too much in property taxes based on US data. This is an unsustainable path given the citizen’s ability to pay and relatively flat population growth.

At this point it makes the most sense for the local government to lower or freeze taxation rates in Rock County, and incentivize the expansion of the local tax base.