Rock County property taxes are in the top 3% of all (3143) US counties, and are even higher than in Dane County property taxes, based on percentage of property value!

Financial freedom is less about financials and more about personal freedom. In Rock County, your property taxes are assessed by the county and Blackhawk Technical College, as well as your city/municipality and school district. It is your elected representatives who oversee these local governmental bodies and are resposible for setting their tax levies. This is what drives your individual property taxes. If you would like to speak to your local elected officials directly, you can find their contact information HERE.

So the point is, fair taxation has to take into account the citizen’s ability to pay the taxes, among other factors. Our local elected officials on county, municipal and school district boards are entrusted to maintain FISCAL RESPONSIBILITY.

Collectively, these boards have led to this high taxation issue in Rock County. So as a citizen, your role is to elected officials who will be focused on FISCAL RESPONSIBILITY, and have proven so through action.

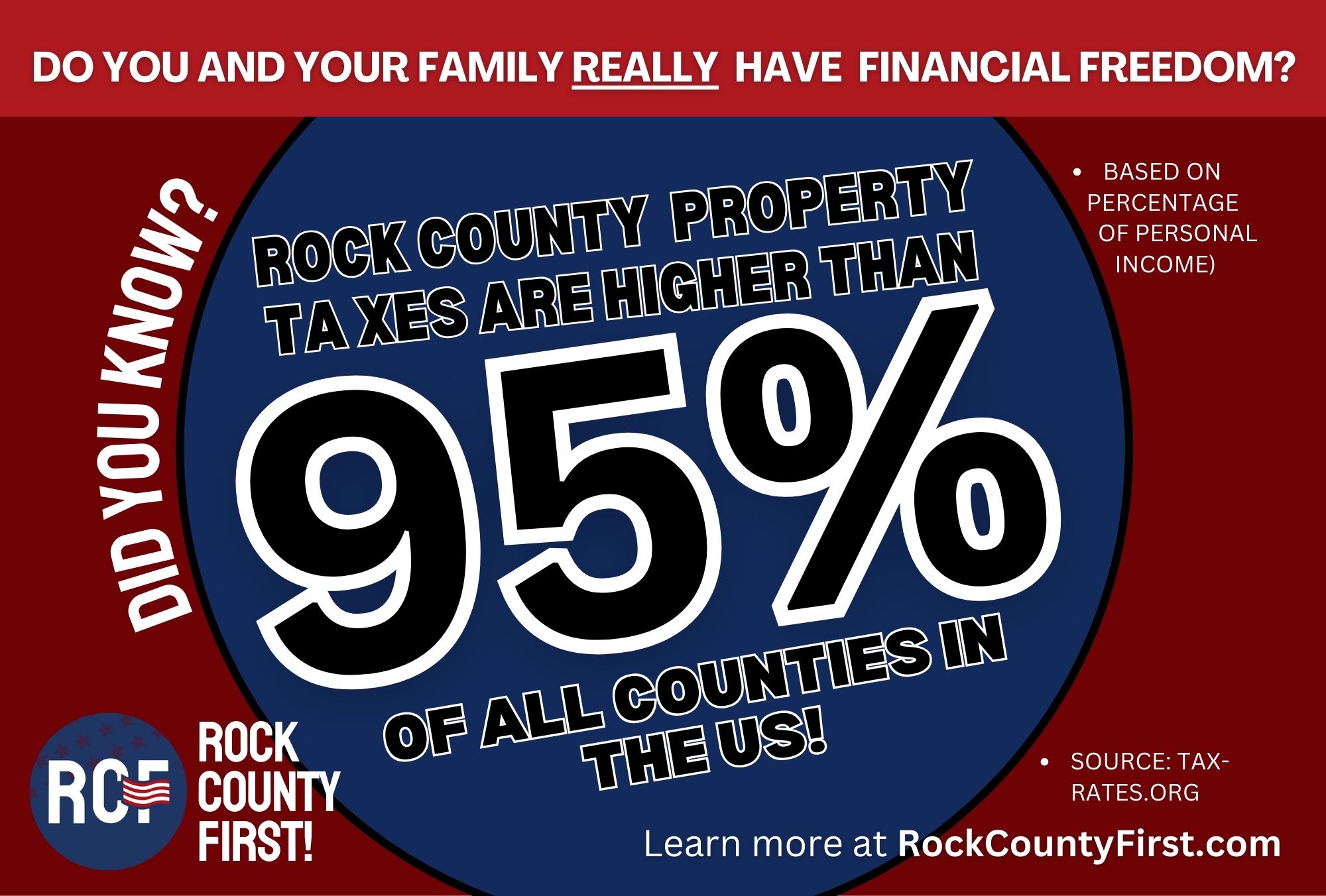

According to 2024 Tax-Rates.org, Rock County property tax comparison to US:

● MEDIAN PROPERTY TAX: If Rock County median property taxes, as a percentage of median income, are 255th out of 3143 counties across the US, this puts Rock County property taxes in the TOP 8% in the US!

● PERCENTAGE OF INCOME: If Rock County property taxes, as a percentage of income, is 143 of 3143 counties across the US, this puts Rock County property taxes in the TOP 5% in the US!

● PERCENTAGE OF PROPERTY VALUE: If Rock County property taxes, as a percentage of property value, is 100th (1.96% of property’s assessed fair market value) out of 3143 counties across the US, this places Rock County property taxes in the TOP 3% in the US!

Rock County property tax vs Dane County:

● Rock County property taxes (1.96%) are even higher than Dane County

(1.8%) property taxes, based on a percentage of property value!

Do You Really Have Financial Freedom?